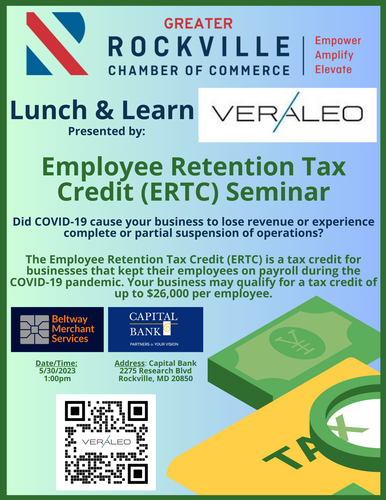

LUNCH & LEARN: Employee Retention Tax Credit (ERTC) Seminar

LUNCH & LEARN Presented by VerAleo.

Business owners, did COVID-19 cause your business to lose revenue or experience complete or partial suspension of operations? The Employee Retention Tax Credit (ERTC) is a tax credit for businesses that kept their employees on payroll during the COVID-19 pandemic. Your business may qualify for a tax credit of up to $26,000 per employee.

VerAleo is a Bethesda-based firm of tax attorneys, attorneys, CPAs, data analysts, and project managers helping clients navigate complex tax & accounting matters.

Colie Daniels is the Manager of Sales at VerAleo Capital Partners, specializing in helping companies under 500 W2 employees with the Employee Retention Credit (ERC) Filing. If you are not familiar, a company under 500 W2 and over 2 W2 employees can receive up to $26,000 per W2 employee for business disruption. In addition to ERC, we also provide financing for companies via short-term loans, gap funding, and ERC advances. Doing an ERC advance speeds up the wait time to receive your tax refund. If you're a business owner that meets these criteria, please connect with Colie at colie.daniels@veraleo.co.

Colie Daniels is the Manager of Sales at VerAleo Capital Partners, specializing in helping companies under 500 W2 employees with the Employee Retention Credit (ERC) Filing. If you are not familiar, a company under 500 W2 and over 2 W2 employees can receive up to $26,000 per W2 employee for business disruption. In addition to ERC, we also provide financing for companies via short-term loans, gap funding, and ERC advances. Doing an ERC advance speeds up the wait time to receive your tax refund. If you're a business owner that meets these criteria, please connect with Colie at colie.daniels@veraleo.co.

Date and Time

Tuesday May 30, 2023

1:00 PM - 2:00 PM EDT

Fees/Admission

For Business Owners and Principals operating before the COVID-19 pandemic.